Crypto Breaking News Today September 2025 Market Update & Analysis

Stay ahead with today’s most urgent cryptocurrency updates, market stats, and global trends. Updated: September 15, 2025

Current Market Context

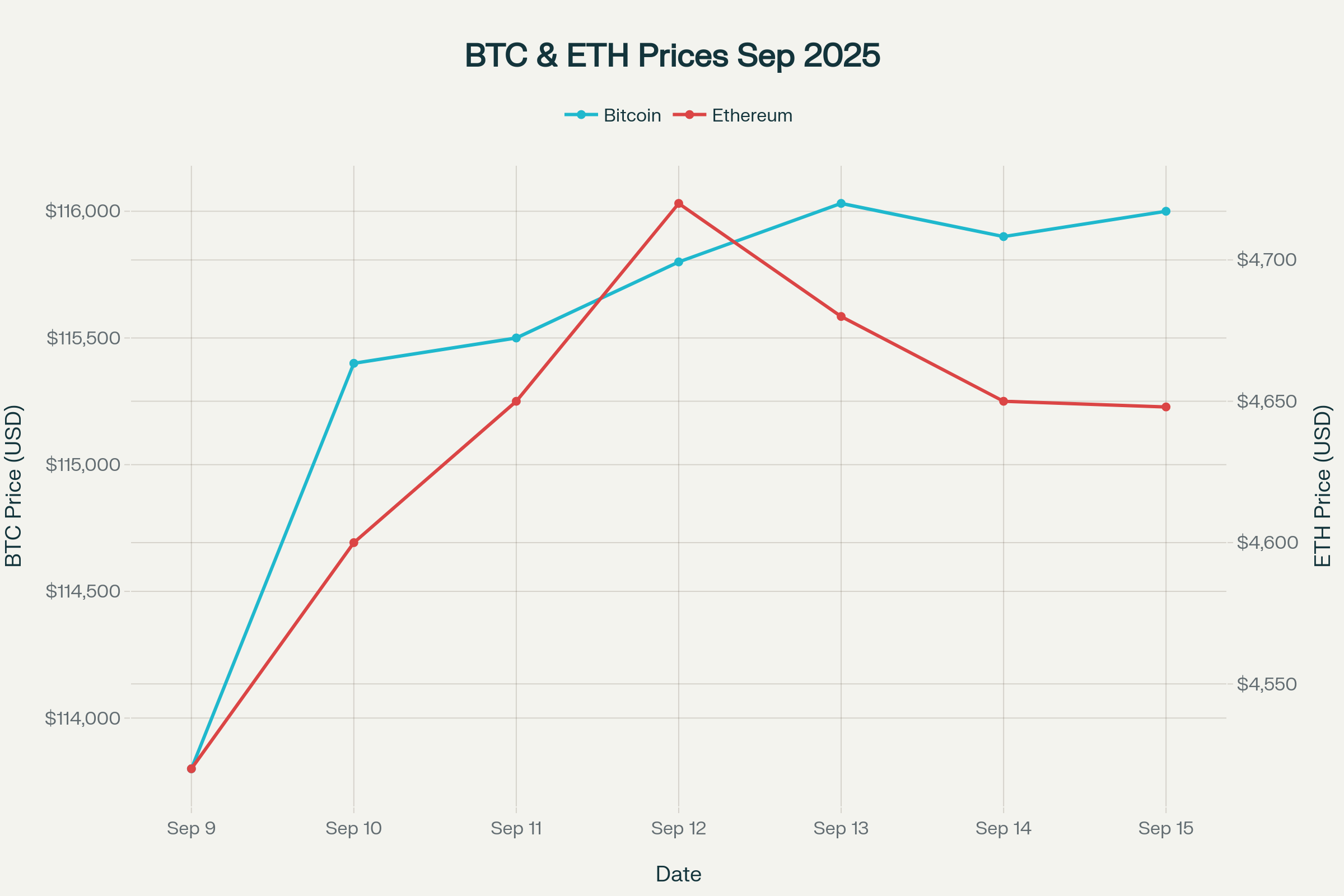

As of September 15, Bitcoin trades near $116,000 after a 4% rally this week, while Ethereum is consolidating around $4,650. The overall crypto market capitalization stands at $4.06 trillion, with notable movements across altcoins.

[Live data: CoinMarketCap, ET Markets]

| Coin | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

| Bitcoin (BTC) | $116,000 | +0.19% | $2.2 T |

| Ethereum (ETH) | $4,648 | -0.33% | $550 B |

| Solana (SOL) | $242 | +3.87% | $85 B |

| XRP | $3.15 | +1.1% | $135 B |

Why It Matters

Crypto market moves this week signal growing investor optimism as the U.S. Federal Reserve considers rate cuts. Institutional inflows, ETF approvals, and technical breakouts are driving surges in top coins.

Market volatility remains high, with trading volumes and liquidity surging on major exchanges.

[Expert commentary: CoinSwitch Markets Desk, ET Markets]

The crypto market’s global reach means these fluctuations impact both institutional giants and retail traders, affecting the wider economy and regulatory landscapes.

Expert Analysis & Predictions

Analyst Opinions

- Bitcoin shows bullish momentum, supported above $115,400; resistance at $117,500. Analysts see parabolic rally potential if Fed confirms dovish outlook—targets of $120,000–$128,000 by end September.

[Analysis: Changelly, InvestingHaven] - Ethereum likely to consolidate around $4,650–$4,700, with upside toward $5,000 if ETF flows ramp up. Network upgrades and shrinking exchange reserves are positives for ETH.

- Altcoins like Solana, XRP, and meme coins (BullZilla, Shiba Inu) are attracting attention for breakout opportunities—Solana above $240 could aim for $261 this month.

[Trending: Tribune India, Giottus]

Market Scenarios

- Short-term: High volatility expected post-Fed meeting (Sep 17). Cautious positioning—key support levels for BTC ($113,500) and ETH ($4,550).

- Long-term: If rate cuts are confirmed, expect bullish continuation; hawkish policy could trigger corrections toward $110,000 for BTC.

- Potential Movers: Solana, Polygon, BullZilla, and Avalanche show strong technical setups for Q4 growth.

Risks & Warnings

Crypto remains volatile—whales and institutions hold tightly, but regulatory uncertainty and scams are ever-present. Security risks (hacks, exploits) and rapid price swings can impact investments.

Be wary of paid promotions and presale coins that lack clear transparency. Always verify before investing.

[Risk reference: 99Bitcoins, Tribune]

Future Outlook

With macroeconomic headwinds fading and regulation evolving, experts anticipate a crypto market rebound in late September and early Q4 2025.

- Upcoming launches: BullZilla presale, further Ethereum upgrades, multiple stablecoin policy changes.

- Events: Fed FOMC, major ETF approvals, Spain's MiCA rollout.

Analysts expect increased institutional flows, especially if the Fed signals rate relief. Bitcoin and select altcoins could hit new highs before year-end.

Conclusion

The September 2025 crypto market shows both opportunity and risk—strong technical setups, institutional momentum, and regulatory news shaping the landscape.

CRYPTO MIND AI continues decoding the future of crypto for investors and enthusiasts.

Stay tuned for more in-depth analysis and up-to-the-minute news.

Author: CRYPTO MIND AI

Email: hello.cryptomindai@gmail.com

Disclaimer: This blog is for informational purposes only. Crypto investments carry risk. Please consult a financial advisor before making any investment decisions.